4 Simple Techniques For Copy Of Bankruptcy Discharge

Table of ContentsThe 9-Minute Rule for How To Get Copy Of Chapter 13 Discharge PapersWhat Does Chapter 13 Discharge Papers Mean?Some Known Details About How To Get Copy Of Bankruptcy Discharge Papers Our Copy Of Bankruptcy Discharge StatementsThe 6-Second Trick For How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Lawyer's are not required to keep insolvency filings. This does depend upon each lawyer. The Discharge records are totally free if the personal bankruptcy released much less than 30 schedule days from today if gotten on this site. "Free Bankruptcy Documents"A. All Corporation as well as Company Record, might be bought by calling the united stateA. Insolvency documents utilize to be maintained indefinitely till 2015. Laws have actually now changed to maintain bankruptcy apply for only two decades. This has triggered an issue, with what is refereed to as "zombie" debt. Visit the credit rating page. A. If you file bankruptcy, It comes to be public document, as well as will certainly be in the "public document" area of your credit history report.

If you filed insolvency in 2004 or prior, your documents are restricted, as well as may not be available to order digitally. Call (800) 988-2448 to examine the schedule prior to purchasing your documents, if this uses to you.

The Of Chapter 13 Discharge Papers

U.S. Records cost's to help in the access process of acquiring personal bankruptcy documents from NARA, relies on the moment engaged and also price included for U.S. Records, plus NARA's fees The Docket is a register of basic information during the personal bankruptcy. Such as status, case number, filing as well as discharges days, Lawyer & Trustee details.

If you're late paying the tax obligation, keep the return 2 years from the day you paid or three from when you submitted (whichever is later on). When it pertains to invoices, if there's a warranty, maintain the receipt till the warranty runs out. Or else, for anything you may need to reclaim, just keep the invoice up until the return duration is up.

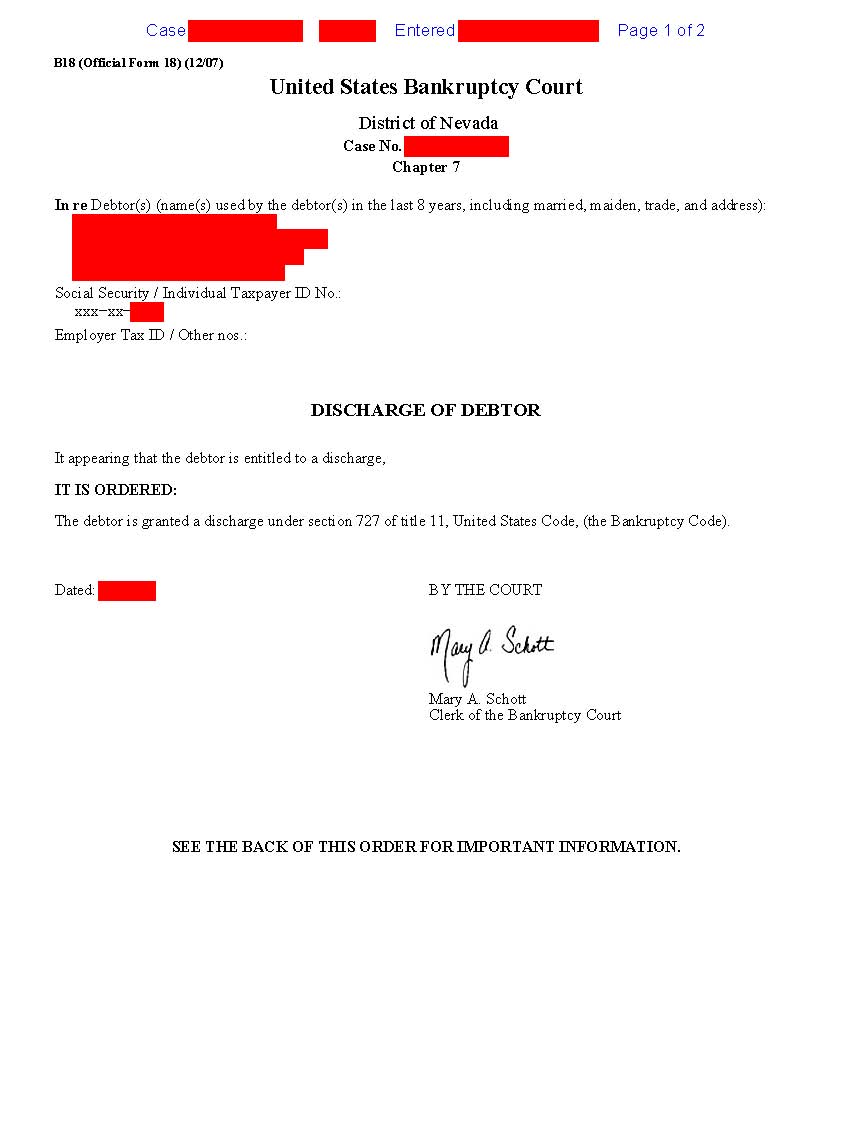

Although your insolvency application, files, and discharge feel like financial files that can fall under the same timeline as your tax obligation docs, they are NOT (how do i get a copy of bankruptcy discharge papers). They are much much more vital as well as ought to be maintained indefinitely. Lenders may return as well as try to accumulate on a financial obligation that became part of the insolvency.

Copy Of Chapter 7 Discharge Papers Fundamentals Explained

Creditors sell off poor debt in pieces of thousands (or hundreds of thousands) of accounts. Bad debt customers are frequently hostile and unethical, and also having your bankruptcy documents on-hand can be the fastest means to shut them down and maintain old items from popping back up on your debt record.

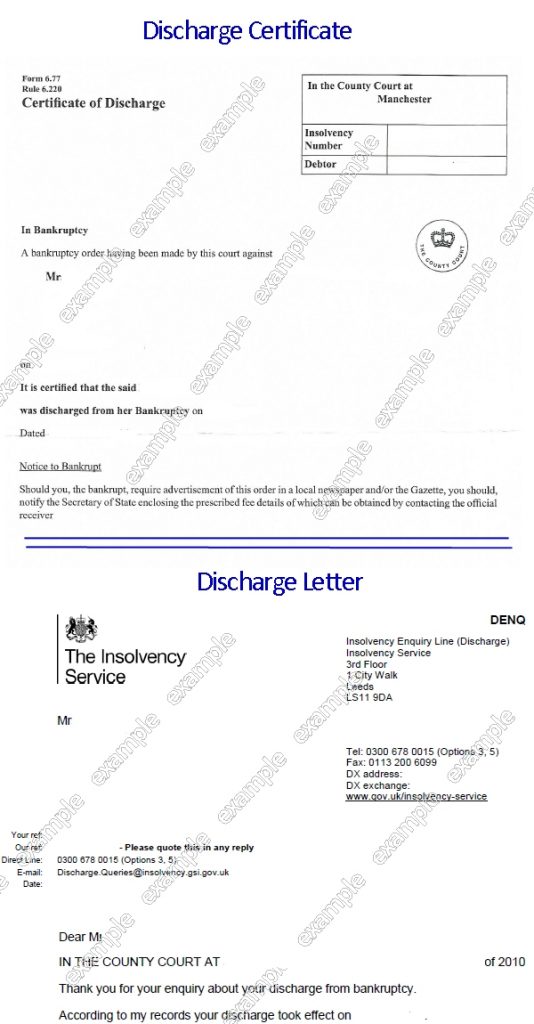

Having actually accredited duplicates of your documentation can stop a delay in your licensure. The brief response? All of them. Getting duplicates of your insolvency papers from your lawyer can take time, especially if your situation is older as well as the duplicates are archived off-site. Obtaining personal bankruptcy papers from the Federal courts can be expensive and also time-consuming.

Maintain every web page - https://www.madschool.edu.sg/profile/bankruptcydischargepapers8426/profile. Obtain a box or huge envelope and also placed them all inside. It's much better to conserve too much than insufficient. Place them in a refuge, as well like where you maintain your will certainly as well as other essential monetary records as well as just leave them there. If you never ever require them, excellent.

What Does How To Get Copy Of Bankruptcy Discharge Papers Do?

A discharged financial obligation literally goes away. Debts that are most likely to be released in a bankruptcy proceeding include credit history card financial obligations, medical costs, some legal action judgments, individual fundings, responsibilities under a lease or other agreement, as well as other unsafe financial debts.

You can't merely ask the insolvency court to discharge your financial obligations because you don't desire to pay them. You have to finish all of the requirements for your personal bankruptcy case to obtain a discharge.

Bankruptcy Trustee, as well as the trustee's lawyer. The trustee directly manages your insolvency case.

The 10-Minute Rule for How To Get Copy Of Chapter 13 Discharge Papers

You can file a movement with the insolvency court to have your situation resumed if any kind of financial institution attempts to accumulate a discharged financial debt from you. The lender can be fined if the court figures out that it broke the discharge order. You can try merely sending out a duplicate of your order of discharge to quit any kind of collection activity, and after that chat to an over at this website insolvency attorney regarding taking lawsuit if that doesn't function.

The trustee will certainly liquidate your nonexempt possessions and divide the earnings amongst your financial institutions in a Chapter 7 bankruptcy. Any type of debt that continues to be will certainly be released or gotten rid of. You'll become part of a settlement strategy over three to five years that pays off all or many of your financial obligations if you file for Chapter 13 protection.